Mar 10th 2023

Fluid Control in 2023: Automation Trends in Control Valves

Digital transformation is driving change in various sectors of the economy, with manufacturers and process industries leveraging automation to overcome inherent operational challenges. This continues to increase demand for control valves, with a focus on digitizing their operation and improving their precision and positioning. The automation solutions enhance the productivity and safety of various industrial systems while facilitating significant cost savings. Which automation trends in the fluid control sector should you watch in 2023?

Intelligent control valve positioners

Control valve positioners improve the reliability and precision of fluid control systems. The positioners adjust the positions of control valves based on the inputs from the process controller and control process variables like flow rates, system pressure and the direction of fluid flow; the positioner achieves these by manipulating the position of the valve actuator or valve stem to a predetermined position as set by the process controller. Valve positioners also compensate for process variations like temperature changes that may cause valves to deviate from their predetermined setpoints. They also improve the responsiveness of automated control systems and reduce interruptions due to oscillations or instabilities in the fluid system.

Control valve positioners should satisfy multiple industry standards to provide reliable fluid control in different environments. The design process considers:

- Component reliability and durability

- Low energy consumption

- Predictive diagnosis capabilities

- Operational efficiency

Valve manufacturers rely on digital technologies to optimize the functionality of control valve positioners. The digitally-backed control valve positioners perform better than traditional electrical or pneumatic valve positioning systems. In 2023 and beyond, valve manufacturers will explore advanced technologies to optimize the functionality of control valve positioners and provide adequate fluid control mechanisms to meet valve demands as the world transitions to smart manufacturing and Industry 4.0.

Intelligent control valve positioners will spur innovation in the valve industry. The demand for device diagnostics means valve manufacturers will increasingly integrate sensor technologies in designing and fabricating control valves and positioners. Utilizing Hall effect sensors will enhance valve positioner feedback acquisition and improve remote valve diagnosis. Other technologies dictating the evolution of intelligent control valve positioners include:

- Use of energy-efficient central processing units to enhance the autonomy of valve positioners

- Implementing intelligent control systems for performance monitoring, self-diagnosis and enhanced fail-safe capabilities. The advanced control systems store historical valve performance data

- Equipping control valve positioners with fugitive emission and internal valve friction monitoring sensors

AI-integrated public utility valves

Utilities like power plants, municipal water supply pipelines, wastewater treatment and sewer systems are designed to serve huge populations and are expected to last long. These utilities rely on various control valves with unique performance capabilities. Companies face multiple challenges when handling public utility valves, ranging from the harsh environmental conditions valves are exposed to, aging infrastructure which increases pressure on process valves, and valves in remote or inaccessible locations, rendering them non-maintainable. These challenges make it difficult for utility companies to meet the desired pipeline performances.

In 2023, companies will continue leveraging strides in artificial intelligence (AI) to address challenges associated with public utility valves. Increasing the integration of AI in public utilities will improve decision-making on the choice of process valves, valve cycling requirements and maintenance regimes. Companies can collect adequate data to develop utility-specific algorithms and leverage them to improve system performance, rethink valve designs and retrofit aging control valves.

Companies can fit sensors on critical public utility valves to monitor process variables like system pressure, temperature, fluid viscosity or fluid quality. For example, using AI algorithms in a water pipeline helps utility companies to forecast demand based on previous events. The technology can also enhance risk mitigation measures using real-time valve performance data, enabling companies to combat incidents like pipe bursts, backflows due to check valve defects or leakages caused by damaged control valves.

Utility companies seeking to recondition aging infrastructure require data to identify distribution networks, power plants or sewer treatment pipelines to prioritize. The AI algorithms analyze the performances of these systems and can predict which assets require immediate attention. Companies utilize such information to devise an inclusive plan to initiate network or component reconditioning.

Companies will focus on improving AI data processing and decision-making capabilities, integrating AI technology in manufacturing process valves and utilizing AI-generated data in control valve design to maximize performance, safety and durability.

Valve condition monitoring

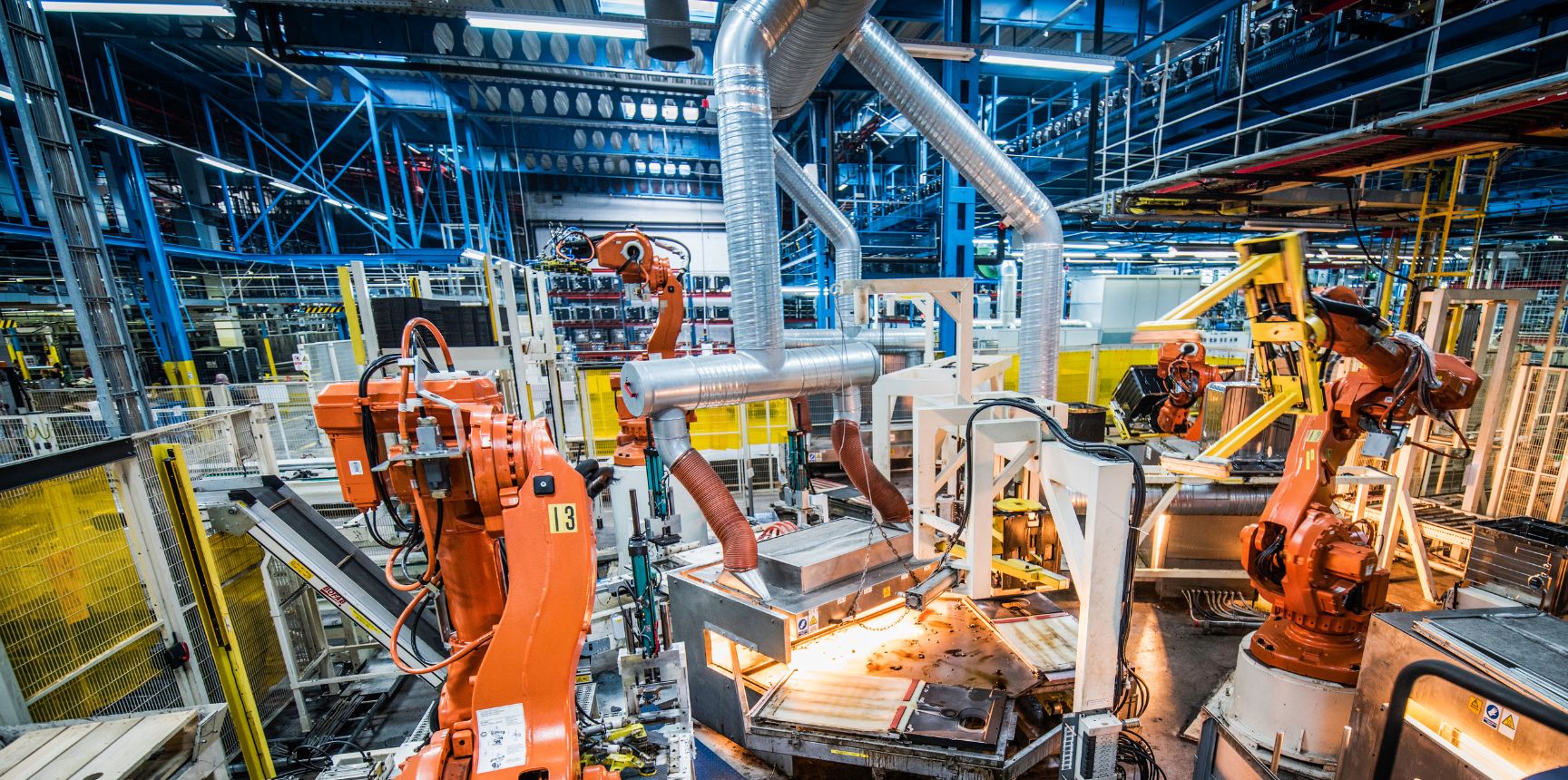

It is difficult to discuss issues of automation without mentioning condition monitoring. Automation results from continuous process and workflow monitoring — historical data guides process engineers on what activities or valves to automate.

Condition monitoring may sound complicated since it leverages several digital technologies for data collection, analysis and process improvement. Companies are continuously adopting valve condition monitoring to maximize the productivity and safety of facilities.

The demand for condition-monitoring technology will soar in 2023 and beyond as companies aim to reduce unplanned downtime due to control valve failures. Companies will advance the utilization of non-intrusive valve condition monitoring by improving the responsiveness and sensitivity of internet of things (IoT) sensors. Such advances will also strengthen remote valve operations and centralize data collection from various control valves spread across a facility or piping network.

Condition monitoring also simplifies a company’s transition from corrective to proactive valve maintenance. Companies monitor the performance of different control valves in real-time and develop a database and algorithms that can predict when failures are likely to occur based on the prevailing valve performance metrics. Predictive maintenance reduces the likelihood of unplanned process downtime due to damaged valves, extends valve durability and reduces expenditure on valve maintenance.

Other technologies to watch in 2023 that are pivotal for streamlining valve condition monitoring include:

- Cloud computing provides a centralized data management platform. The technology is scalable and allows companies to optimize data management even as the quantity of hardware under condition monitoring grows.

- Big data analytics, a technology that provides real-time capabilities to detect anomalies and identify valve performance patterns based on collected sensor data

- Virtual and augmented reality for training technicians and field employees on ways to leverage condition-monitoring data to improve control valve performance

Digital twins and valve reconditioning

It is easy to assume that the valve sector plays catch-up in innovation. It is because valve designs remain unchanged. However, plenty of work happens in labs and design centers. Digital twin technology is one of the latest advancements valve manufacturers utilize to develop advanced valve designs and recondition old, rare and critical process valves.

Digital twins involve creating virtual (digital) replicas of physical systems, in this case, control valves. Manufacturers combine sensor data and AI-generated analytics to create digital valve replicas and develop simulations to analyze valve performance characteristics.

Companies will continue leveraging digital twins as they continue reconditioning aging valves. Field technicians can remotely perform risk analysis and identify potential work issues before visiting work sites for corrective maintenance or conducting a valve component replacement. These measures are essential for effective planning and selecting appropriate mitigation measures to address potential maintenance or repair challenges.

Companies use digital twins to simulate valve performances under different operating conditions. Field personnel can identify optimum conditions under which they can complete valve reconditioning without extending process downtime or extending control valve damage. Some old process valves are difficult to automate. Companies can utilize the digital twins to create digitized valve performance records and capture information on maintenance histories, valve usage patterns and frequency of breakdowns. The availability of such information is critical for designing advanced replacement valves, optimizing valve maintenance schedules and improving the lifespan and performance of the target valve.

Additive manufacturing for control valves

The demand for valves in different sectors of the economy continues to drive change in manufacturing processes. Valve manufacturers implement sustainable production processes to minimize waste and develop long-lasting fluid control devices. Valve manufacturers will continue leveraging additive manufacturing technologies to bridge the demand for high-quality products and customize valves for different applications.

Valve manufacturers should watch advances in 3D printing technology and identify ways to integrate these solutions into existing production processes. With additive manufacturing, companies can create complex control valve geometries that traditional manufacturing techniques cannot achieve. The complex valve geometries allow manufacturers to optimize the performances of different valves.

Additive manufacturing will be a game-changer in modern and future valve manufacturing since companies can produce valves faster and at lower costs. These companies can also explore the suitability of advanced valve manufacturing materials for particular applications. It means these manufacturers can fabricate replacement parts to recondition aging valves.

Although additive manufacturing reduces lead times, companies should explore ways to improve valve compliance with several industry standards and enhance the quality of manufacturing materials to meet harsh operating conditions.

Final words

The control valve sector will continue experiencing technological changes in 2023 and reshape valve manufacturing, maintenance and reconditioning. The different technologies are beneficial for maximizing the performance and durability of control valves. Companies should explore ways to integrate these technologies into their routine operations and improve those solutions already in use in this sector. These technologies are capital intensive, and control valve manufacturers and maintenance companies should implement those that solve their most pressing challenges. Scale these technologies if they deliver a substantial return on investments.